Australia resilient despite global turmoil

-

The Australian dollar finished the week higher against most G10 counterparts, as strong rallies in the S&P 500 boosted the highly risk-sensitive currency. General improvement in market risk appetite allowed the AUD/USD to break above major technical resistance, and technicians have subsequently called for further near-term appreciation. Yet we remain mindful of false dawns for broader financial markets—these moments of relative complacency often invite significant deterioration in financial conditions. A relatively empty week of Australian economic event risk means that the Aussie dollar will remain at the mercy of broader risk sentiment moves. Needless to say, it will be critical to watch shifts in the S&P 500, ASX, and other key sentiment indicators.

Recent Australian economic data suggests that domestic conditions remain surprisingly resilient—boosting overall outlook for the domestic currency. Australian officials reported that the domestic economy added a net 1,800 jobs in the month of February, but a jump in the labor Participation Rate meant that joblessness increased. The domestic unemployment rate has gained 1.3 percentage points from its trough, while the US unemployment rate has surged 3.7 percentage points through the same period. Given that currencies move in relation to one another, being in the least-bad economic shape bodes well for the Australian dollar.

A relative stabilization in the rate of economic contraction likewise led the Reserve Bank of Australia to leave rates unchanged through their most recent decision—boosting the AUD’s yield advantage versus other key currencies. Australian growth prospects remain bearish in the face of massive global economic headwinds, but there is evidence to suggest that the AUD could benefit from more severe economic deterioration in other major world economies. We will subsequently have to keep close watch on economic data out of Australia, the US, and other key counterparts. -

aussies =.=

-

Originally posted by Worldlybusinessman:

The Australian dollar finished the week higher against most G10 counterparts, as strong rallies in the S&P 500 boosted the highly risk-sensitive currency. General improvement in market risk appetite allowed the AUD/USD to break above major technical resistance, and technicians have subsequently called for further near-term appreciation. Yet we remain mindful of false dawns for broader financial markets—these moments of relative complacency often invite significant deterioration in financial conditions. A relatively empty week of Australian economic event risk means that the Aussie dollar will remain at the mercy of broader risk sentiment moves. Needless to say, it will be critical to watch shifts in the S&P 500, ASX, and other key sentiment indicators.

Recent Australian economic data suggests that domestic conditions remain surprisingly resilient—boosting overall outlook for the domestic currency. Australian officials reported that the domestic economy added a net 1,800 jobs in the month of February, but a jump in the labor Participation Rate meant that joblessness increased. The domestic unemployment rate has gained 1.3 percentage points from its trough, while the US unemployment rate has surged 3.7 percentage points through the same period. Given that currencies move in relation to one another, being in the least-bad economic shape bodes well for the Australian dollar.

A relative stabilization in the rate of economic contraction likewise led the Reserve Bank of Australia to leave rates unchanged through their most recent decision—boosting the AUD’s yield advantage versus other key currencies. Australian growth prospects remain bearish in the face of massive global economic headwinds, but there is evidence to suggest that the AUD could benefit from more severe economic deterioration in other major world economies. We will subsequently have to keep close watch on economic data out of Australia, the US, and other key counterparts.dunt trust all gavaman,incl PAP,official data.

trust men in the street.they will tel u the whole truth.

wat do u think a country will look like when the job advertisments drop

45% in a year as happening in oz?

SG i think also face huge drop in job advert.

So,u can hear MM,SM,PM always remind u that GDP drop

5,6 ,9 and more than 10%,as MM said recently.

SG dunt mind GDP drop 10% and not shy to say so.

Unlike other countries which treat the word RECESSION a shame.

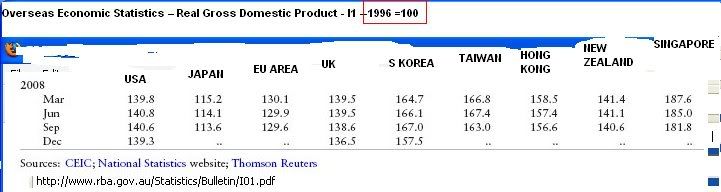

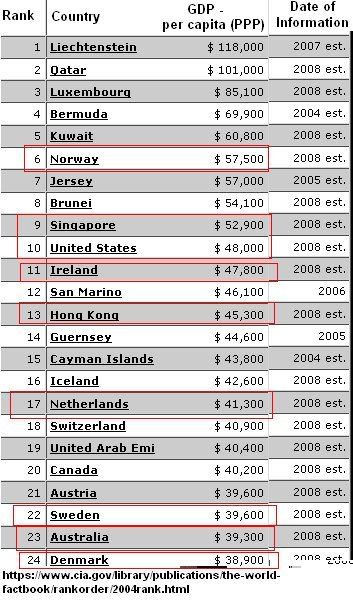

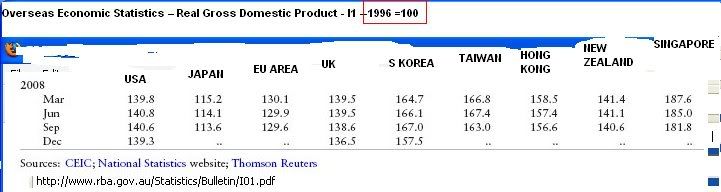

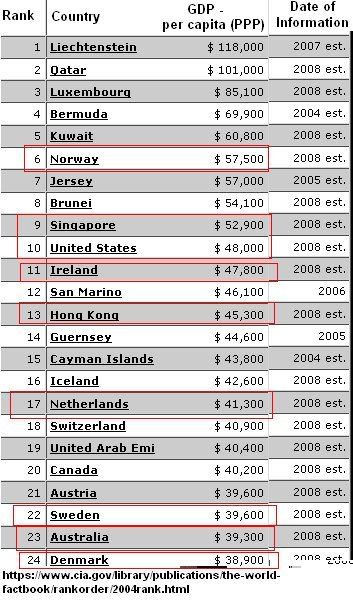

SG GDP grew much faster than other developed countries in the past

20 years,making SG alreedy OVERTAKEN all G 20 countries GDP per capita

at PPP~!!

i remember oz grew abt 55% in the above period!!

SG GDP per capita at PPP alreday exceeding Australia in 1992 and USA in 2005!!

@@@@@@@@@@@@@@@

lok at the reality data--

''The bleak outlook was underlined by a survey from Australia and New Zealand Banking Corp which showed the total number of job advertisements in newspapers and on the Internet fell a steep 8.5 percent in March.That brought the fall since March last year to a huge 44.6 percent, the biggest annual decrease on record.''http://www.guardian.co.uk/business/feedarticle/8440988

''Job advertisements slide for 11th straight month

* Inflation gauge dips in March as petrol prices fall* All adds to case for cuts in interest rates this weekBy Wayne ColeSYDNEY, April 6 (Reuters) - Australian job advertisements slid for the 11th straight month in March, a survey showed on Monday, painting a bleak outlook for unemployment and adding to the case for another cut in interest rates as early as this week....'' -

a super great econ date source from 1980

http://www.econstats.com/weo/V011.htm

u can see SG overtook OZ GDP per capita at PPP in 1992!!

-

Originally posted by lionnoisy:

dunt trust all gavaman,incl PAP,official data.

trust men in the street.they will tel u the whole truth.

wat do u think a country will look like when the job advertisments drop

45% in a year as happening in oz?

SG i think also face huge drop in job advert.

So,u can hear MM,SM,PM always remind u that GDP drop

5,6 ,9 and more than 10%,as MM said recently.

SG dunt mind GDP drop 10% and not shy to say so.

Unlike other countries which treat the word RECESSION a shame.

SG GDP grew much faster than other developed countries in the past

20 years,making SG alreedy OVERTAKEN all G 20 countries GDP per capita

at PPP~!!

i remember oz grew abt 55% in the above period!!

SG GDP per capita at PPP alreday exceeding Australia in 1992 and USA in 2005!!

@@@@@@@@@@@@@@@

lok at the reality data--

''The bleak outlook was underlined by a survey from Australia and New Zealand Banking Corp which showed the total number of job advertisements in newspapers and on the Internet fell a steep 8.5 percent in March.That brought the fall since March last year to a huge 44.6 percent, the biggest annual decrease on record.''http://www.guardian.co.uk/business/feedarticle/8440988

''Job advertisements slide for 11th straight month

* Inflation gauge dips in March as petrol prices fall* All adds to case for cuts in interest rates this weekBy Wayne ColeSYDNEY, April 6 (Reuters) - Australian job advertisements slid for the 11th straight month in March, a survey showed on Monday, painting a bleak outlook for unemployment and adding to the case for another cut in interest rates as early as this week....''what a cork numskull..GDP per capita as an indicator of economic growth, economic theorists still find flaws and problems with it as an economic tool. Among these problems are, the inability of GDP per capita to provide information about income distribution. Some income derived from the black market, or those which were not reported to the government were not accounted for. Likewise, GDP does not count volunteer work and services provided by social workers and charity institutions. It also do not account for reconstruction work and services done due to national disasters and calamities. Additionally, GDP as a statistical account is subject to fraud especially from those who are engaged in tax evasion processes. Some companies do not foreclose their true gross domestic transactions to lessen their tax payments.

Those are just some of the on going issues behind the value of Gross Domestic Product Per Capita and GDP as a whole. And whether GDP per capita would continue to be of value to economic planners remains to be since and would greatly depend on whether other indicators would be developed. -

and case in point, a country with such a low GDP like Australia (when comparing to Singapore). People enjoy a higher standard of living and have much more disposable income...

GDP is an outward appearance meant to look good on paper to entice trade, but it is not a indicator of national progress because it doesnt take into account the cost of living, disposable income, wealth distribution ect ect.

-

GDP is of no concern to countries with natural resources.

-

Originally posted by Worldlybusinessman:

and case in point, a country with such a low GDP like Australia (when comparing to Singapore). People enjoy a higher standard of living and have much more disposable income...

GDP is an outward appearance meant to look good on paper to entice trade, but it is not a indicator of national progress because it doesnt take into account the cost of living, disposable income, wealth distribution ect ect.

u seem under play GDP lah.Nvm.

i cant see how people staying in a city can really enjoy life:

--------gun shots or drive by shooting is a way of life city

----kids can buy drugs like getting a 7-Eleven store to buy ice -cream

---no major defense platforms can go to war....

------40 ATM were blown up and still go on

----..............................

-

i say fark u and fark again lionnoisy...

Go back to r rathole , and from this post i know that u are not highly educated , and not defintely from the field of economics and finance.

the single best gauge of economic performance is not growth in GDP, but GDP per person, which is a rough guide to average living standards. It tells a completely different story.

GDP growth figures flatter America's relative performance, because its population is rising much faster, by 1% a year, thanks to immigration and a higher birth rate. In contrast, the number of Japanese citizens has been shrinking since 2005. Once you take account of this, Japan's GDP per head increased at an annual rate of 2.1% in the five years to 2007, slightly faster than America's 1.9% and much better than Germany's 1.4%. In other words, contrary to the popular pessimism about Japan's economy, it has actually enjoyed the biggest gain in average income among the big three rich economies.…Take the case of singapore, though its GDP is higher than US, most of its population live in average or poverty standards.

-

It tells u the income per head and it is found by dividing the GDP by population, this is worthless and it doesn't tell anything.

Assume there are two countries. Country A's GDP per capita is $1000 and cost of living per head is $500 and Country B's GDP per capita is $5000 and cost of living is $3500. In country A the cost is 50% of income while in coutry B the cost is 70% of income. To prove my point GDP or GDP per capita doesn't tell the standard of living of a country. -

Nice one, businessman.

As for lion...

For god's sake, leave the Aussies alone. They hate us because people like *you have nothing better to do than trash them without provocation.

-

that cut-and-paste of sh^t doesnt know what he is talking about. GDP only tells about trade and economic activity.