the use of a bank nowadays

-

that was my first thought too.

but it just didn't seem to fit in that context.

-

Originally posted by deathbait:

the EV SHOULD be the same

SHOULD. In a perfect free market.

I'm not sure you took economics either.

And btw , my degree was in comp sci. I'm just working in the financial sector now. What's YOUR excuse for incompetence?

Btw, EV does not take in account retardation factors such as inflation. Do you even know what Expected value is? Anything above the risk-free interest rate carries risk for greater rewards. Investing is such an activity. Since when is there a written guarantee that you have to be able to break even with inflation? If that were the case, inflation would not be a problem at all.

No, I must confess your MV is a mystery to me. Perhaps you would like to enlighten me?

Expected value (EV) should be the same?!?!?!

Have you provided proof from your calculations or is it your guess again?

Obviously you lacked knowledge of MV in Finance. If you have no idea what MV is, go asked the colleagues in your company.

Since you already agree that your EV or risk/reward curve does not take into account inflation.

I believe that you would no longer have any contention with my original statement of,

"Before one talk about risk/reward curve, one should consider if the interest rates can even cover the inflation rate".

Which authority controls the exchange rates and bank rates in Singapore?

Don't be daft, of course I know what EV is, else I wouldn't have the slightest idea what it is, when you first used the term EV without explanation.

I responded telling you that it's Expected Value.

Else I would be looking dumbfounded like you right now, trying to figure out what MV is and begging an explanation from me.

Don't you find it strange that a graduate in Computer Science, talking with such boisterous confidence and authority in Economics and Finance,

when no proof of competence was inherent.

***I have this strong feeling that your colleagues will most likely tell you it's Market Value. Hahahahaha..................

Happy shifting bits and bytes.

-

what is the average interest rate for most bank?

-

Originally posted by maurizio13:

Expected value (EV) should be the same?!?!?!

Have you provided proof from your calculations or is it your guess again?

Obviously you lacked knowledge of MV in Finance. If you have no idea what MV is, go asked the colleagues in your company.

Since you already agree that your EV or risk/reward curve does not take into account inflation.

I believe that you would no longer have any contention with my original statement of,

"Before one talk about risk/reward curve, one should consider if the interest rates can even cover the inflation rate".

Which authority controls the exchange rates and bank rates in Singapore?

Don't be daft, of course I know what EV is, else I wouldn't have the slightest idea what it is, when you first used the term EV without explanation.

I responded telling you that it's Expected Value.

Else I would be looking dumbfounded like you right now, trying to figure out what MV is and begging an explanation from me.

Don't you find it strange that a graduate in Computer Science, talking with such boisterous confidence and authority in Economics and Finance,

when no proof of competence was inherent.

***I have this strong feeling that your colleagues will most likely tell you it's Market Value. Hahahahaha..................

Happy shifting bits and bytes.

you talk so much and understand so little.

Your argument only stands if you agree the market is not a free one. In which case, all bets are off, because that's the basic assumption behind all theory.

EV has to be the same for a perfect free market. That is the basic characteristic. You can rant all you want about making free profits in investments. End of the day, if you don't understand the risk/reward curve tradeoff, you're just deluding yourself.

-

Originally posted by deathbait:

you talk so much and understand so little.

Your argument only stands if you agree the market is not a free one. In which case, all bets are off, because that's the basic assumption behind all theory.

EV has to be the same for a perfect free market. That is the basic characteristic. You can rant all you want about making free profits in investments. End of the day, if you don't understand the risk/reward curve tradeoff, you're just deluding yourself.

No point for me to teach you at my expense for your benefit.

If you choose to think that the expected value for savings interest rate is the same as stocks, so be it.

You have yet to ask your colleagues in your finance company for their interpretation of MV.

Here's another clue, maybe it will ring a bell.

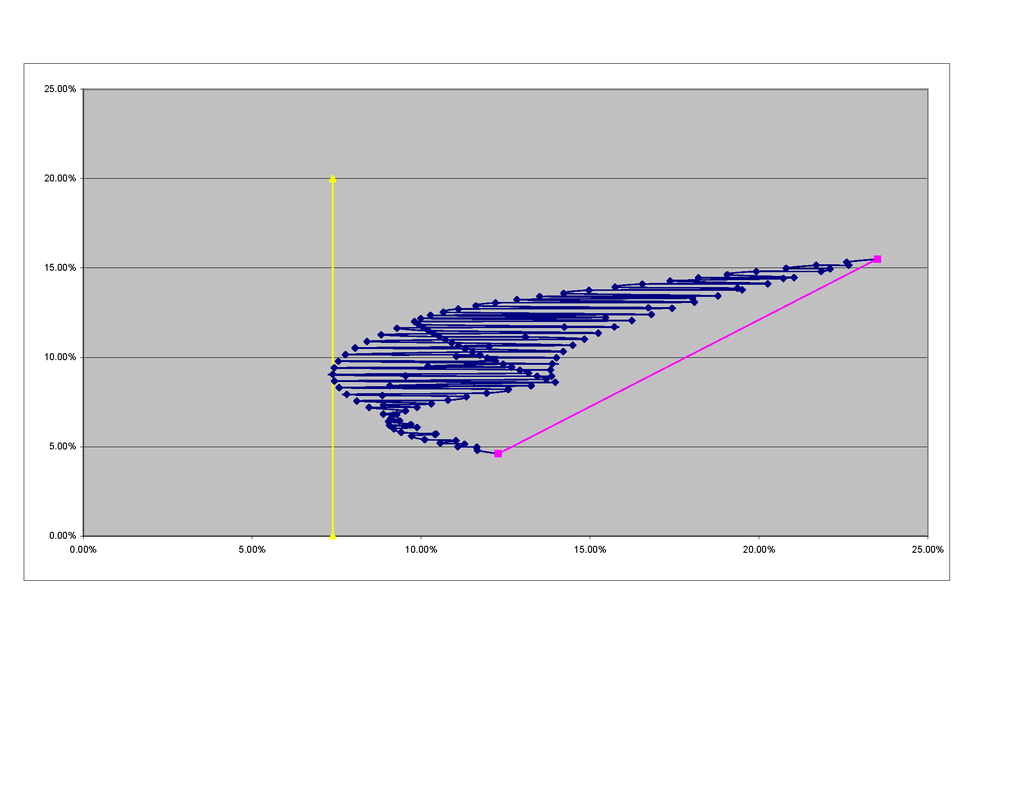

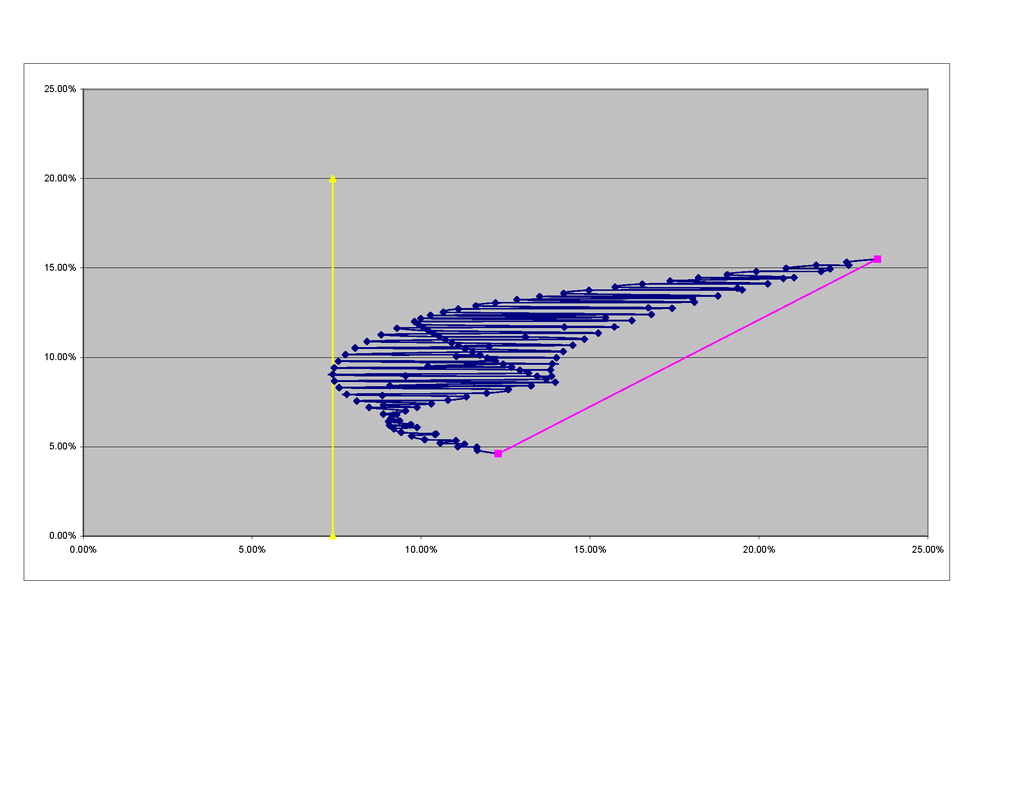

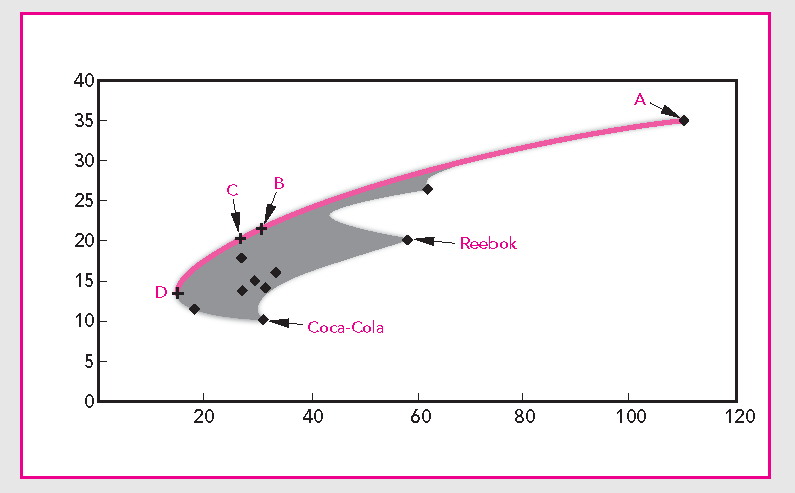

The graph is entirely my contrivance, I have removed the labels for the X and Y axis to make it more interesting for you.

I am sure those who studied Finance will know what I am talking about.

It sure looks like the

man logo doesn't it?

man logo doesn't it?

-

lets not fight.

lets help enlighten one another.

thanks for all your infos.

lets focus on our public enemy #1.

happy holidays.

-

Originally posted by balance_else_complacent:

lets focus on our public enemy #1.

........& that would be.................

-

Originally posted by balance_else_complacent:

being a layman,

i have this wild thought how to improve the situation:

1. since banks IR so so low, why not put in overseas banks?

2. if there are overseas good banks able to pay more interest, can we lump together many people's money into 1 big sum and put into overseas banks that give more interest and earn more interest using a combined account?

But i worry that like this, local banks will go kaput.

but then again, if this happens the banks might react to retain the 'talents'.

Your concern could be addressed by purchasing treasury bills/notes which are effectively risk-free (so long as you buy those in civilisations that are remotely human :P ) - treasury bills/notes effectively pay you the interest upfront and the rest at maturity.

In addition, should circumstances change favourably prior to maturity, you could always trade your bills/bonds (known as securities trading) OTC, which effectively locks in your profit.

-

Originally posted by maurizio13:

No point for me to teach you at my expense for your benefit.

If you choose to think that the expected value for savings interest rate is the same as stocks, so be it.

You have yet to ask your colleagues in your finance company for their interpretation of MV.

Here's another clue, maybe it will ring a bell.

The graph is entirely my contrivance, I have removed the labels for the X and Y axis to make it more interesting for you.

I am sure those who studied Finance will know what I am talking about.

It sure looks like the

man

logo doesn't it?

man

logo doesn't it?

ok, i have admitted i don't know what you're talking about and you want to milk it.

Fine. I WILL ask my friends about it. Sheesh. I guess we know who's on the ego trip and who's really contributing now.

Still, I would be very surprised indeed if anyone tells me of an economic principle that would cause a difference in the EV between investing in shares and putting it in a bank.

-

Banks of today are here to create the crisis to the world.

The banker bonuses which encouraged excessive risk-taking which cause the financial crisis today.

They basically gamble - as it paid they to gamble - when they win they walk away with huge bonuses, when they lost - they do not share the lost !!! Even if they lost their job, they already walk away with larges sums that they win earlier.The banks change the practise, hold back the bonus for a certain period of years, and if loss for the following years, their bonus is reduce, thus if they are make to share the gain and lost .

-

Originally posted by deathbait:

ok, i have admitted i don't know what you're talking about and you want to milk it.

Fine. I WILL ask my friends about it. Sheesh. I guess we know who's on the ego trip and who's really contributing now.

Still, I would be very surprised indeed if anyone tells me of an economic principle that would cause a difference in the EV between investing in shares and putting it in a bank.

For a person who talks about risk/reward curve as if he is some authority and have no understanding of the graph I posted.

You are really quite a character.

If what you said about expected value of bank interest and investments in other assets is the same.

There won't be any need for investments banks and they will all cease to exist.

-

Originally posted by deathbait:

ok, i have admitted i don't know what you're talking about and you want to milk it.

Fine. I WILL ask my friends about it. Sheesh. I guess we know who's on the ego trip and who's really contributing now.

Still, I would be very surprised indeed if anyone tells me of an economic principle that would cause a difference in the EV between investing in shares and putting it in a bank.

For a person who talks with much authority in risk/reward curves and expected value, you now profess that you have no idea what I am talking about.Managed to get afew copies of exactly the same graph from 2 books (I edited the revealing information), which you might be able to ask your colleagues.

If your friends are still clueless, tell them this work won the researcher a Nobel Prize.

Or maybe you have found out from your friend as to the meaning of this curve, realised your folly and decided to stop blabbing.

-

deathbait,

Where are you hiding???

-

deathbait,

such a long hiatus since your last post.

so........

it's been like almost a month, have you asked or found out from your colleague yet?

-

Hello Friends and Worldly people,

I need your advise.

Given the local banks are giving so so soo soooo soooooooooo sooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo

low interest for savings and FD,

is it feasible to WITHDRAW each and every single little cent I have in a bank and put it in a OVERSEAS bank not registered in the PORE and earn the higher interest?

Will I be taxed for the interest earned from a foreign, unregistered-with-the-PORE bank? How about through a bank in the internet of no borders?

I am sick of 'LENDING' my hardearned money to local banks who give me interest like not giving at all taking into account the INFLATION.

Should we all withdraw all our money from local banks?

This is purely a question.

Hope to get some kind of financial advise.

Danke.

-

Originally posted by balance_else_complacent:

Hello Friends and Worldly people,

I need your advise.

Given the local banks are giving so so soo soooo soooooooooo sooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo

low interest for savings and FD,

is it feasible to WITHDRAW each and every single little cent I have in a bank and put it in a OVERSEAS bank not registered in the PORE and earn the higher interest?

Will I be taxed for the interest earned from a foreign, unregistered-with-the-PORE bank? How about through a bank in the internet of no borders?

I am sick of 'LENDING' my hardearned money to local banks who give me interest like not giving at all taking into account the INFLATION.

Should we all withdraw all our money from local banks?

This is purely a question.

Hope to get some kind of financial advise.

Danke.

Yes, its extremely feasible. In fact, there are international banks operating in Singapore that provides services such as Foreign currency deposits, saving you from the need to go overseas physically and openning a bank account there.

Of course, you will be bearing the foreign exchange risks if you do. And no, you won't be taxed.

-

ok, really appreciate your advise which is the 1st advise I received.

To me, I owe no one nothing. I owe no banks no money. I owe them nothing and do not wish to continue 'lending' them at such pathethic interest rate which is eaten by inflation!!!

i vow to remove every cent.

i hope and do not encourage all to do the same.

Imagine the terror of all withdrawing every cent from our local banks!

that is not what i am hoping...but then, in a democracy, we are free man. We own our money legally and fully can decide what to do with it.

If any of my money is stuck in some financial repository , i vow to remove every cent sooner or later , at all cost.

i value freedom more than life itself.

-

Originally posted by balance_else_complacent:

ok, really appreciate your advise which is the 1st advise I received.

To me, I owe no one nothing. I owe no banks no money. I owe them nothing and do not wish to continue 'lending' them at such pathethic interest rate which is eaten by inflation!!!

i vow to remove every cent.

i hope and do not encourage all to do the same.

Imagine the terror of all withdrawing every cent from our local banks!

that is not what i am hoping...but then, in a democracy, we are free man. We own our money legally and fully can decide what to do with it.

If any of my money is stuck in some financial repository , i vow to remove every cent sooner or later , at all cost.

i value freedom more than life itself.

you asked in the wrong forum

You should post your question either in $Money$ sub-forum or better, within Money Mind in hardwarezone forums

Anyway, quite obvious you do very much about financial planning.

is it feasible to WITHDRAW each and every single little cent I have in a bank and put it in a OVERSEAS bank not registered in the PORE and earn the higher interest?

If the interest rate is 7%, your final is 1.07 more than your original amount. However, you will have to take into account exchange rates. If the exchange rate drops in your favour (and SGD is expected to rise in value), and if it drops 7%, your final is 1.07*0.93 = 0.9951, less than the amount you initially put in.

-

Originally posted by elementalangel:

that is you have a small sum of money..

dbs gives a 1.5% interest a year

so if you have 100mil for instance.. you get 1.5 mil for free.. thats for sure...however if you invest it all dirrectly.. you will get risks... would you want to risk/? would u darea take the risks?

Have you considered your deposit in the bank isn't really default-free as you're led to believe?In Singapore, the deposit insurance is set by the MAS to a limit of just SGD20,000. Basically, 99.98 million of your 100 million is effectively your risk premium...

-

Originally posted by eagle:

If the interest rate is 7%, your final is 1.07 more than your original amount. However, you will have to take into account exchange rates. If the exchange rate drops in your favour (and SGD is expected to rise in value), and if it drops 7%, your final is 1.07*0.93 = 0.9951, less than the amount you initially put in.

Alternatively, you can change your base currency before depositing your money in a foreign account. -

Originally posted by eagle:

you asked in the wrong forum

You should post your question either in $Money$ sub-forum or better, within Money Mind in hardwarezone forums

Anyway, quite obvious you do very much about financial planning.

If the interest rate is 7%, your final is 1.07 more than your original amount. However, you will have to take into account exchange rates. If the exchange rate drops in your favour (and SGD is expected to rise in value), and if it drops 7%, your final is 1.07*0.93 = 0.9951, less than the amount you initially put in.

Walesa has already answered you. Take his advise and you may be richer for it.

I think his points are valid.

the FACT IS : local banks interest for FD and normal savings account no longer serves its purpose in the sense that why should people 'lend' money to banks that basically returns no interest due to INFLATION ? I rather loan my money to friends and earn some kind of respectable interest.

The customers collectively need to decide if drawing out all money from local banks and put it into a new bank that is reliable and gives better return.

We must understand we do not owe the banks nothing. As in Zilch. They need to wake up their ideas. Do not take kuai locals for granted.

-

Originally posted by eagle:

you asked in the wrong forum

You should post your question either in $Money$ sub-forum or better, within Money Mind in hardwarezone forums

Anyway, quite obvious you do very much about financial planning.

If the interest rate is 7%, your final is 1.07 more than your original amount. However, you will have to take into account exchange rates. If the exchange rate drops in your favour (and SGD is expected to rise in value), and if it drops 7%, your final is 1.07*0.93 = 0.9951, less than the amount you initially put in.

Walsea has already answered you. Take his advise and you may be richer for it.

I think his points are valid.

No matter how you say

-

Originally posted by walesa:

Alternatively, you can change your base currency before depositing your money in a foreign account.My post was after I had consulted some UOB person, although I don't really trust him.

Putting in a foreign account, you are still exposed to the long-run risks of the currency market. You never know which way the currency is going to go. Lucky you earn. Unlucky (eg suddenly get sub-prime crisis, etc), then you lose.

Can imagine what happened to those who their fixed D into the US market about 1 year ago?

-

Originally posted by balance_else_complacent:

Walesa has already answered you. Take his advise and you may be richer for it.

I think his points are valid.

the FACT IS : local banks interest for FD and normal savings account no longer serves its purpose in the sense that why should people 'lend' money to banks that basically returns no interest due to INFLATION ? I rather loan my money to friends and earn some kind of respectable interest.

The customers collectively need to decide if drawing out all money from local banks and put it into a new bank that is reliable and gives better return.

We must understand we do not owe the banks nothing. As in Zilch. They need to wake up their ideas. Do not take kuai locals for granted.

If you do that, I believe you will be charged as being a loanshark

It is a known fact that money will be lost to inflation if you put in the bank since years and years ago. Quite surprising you only notice it now.

Even for the bond my gf has purchased, with a requirement to be held for 5 years, giving average of at least 5.28% p.a., is already losing money to the inflation of 6.7%.

-

Originally posted by eagle:

If you do that, I believe you will be charged as being a loanshark

It is a known fact that money will be lost to inflation if you put in the bank since years and years ago. Quite surprising you only notice it now.

Even for the bond my gf has purchased, with a requirement to be held for 5 years, giving average of at least 5.28% p.a., is already losing money to the inflation of 6.7%.

thats right, why should we lend money to banks who use it to invest for themselves?

I will leave them some little money just enough for me to withdraw from ATM for daily expense purposes.

I will put majority of my money in foreign bank or any secure bank for 1 year to try and use internet banking to do money transfers. Even CitiBank and Other Great Foreign Banks that are more international are opening retail banks here and provide ATM machine also.

Thus, Given the INFLATION and LOW LOW SUPER LOW LOW interest given by local banks for savings and FD, there is really no need to owe them in the way of lending their boss my money for them to use at their owns in ways they choose and like and fancy.

No body owes them nothing. This is lesson learnt from life in the PORE. We really do not owe them anything. Their happiness. If we continue to leave money there, they continue to enjoy at my expense. Only when they give higher interest surpassing the inflation by 2 percent then only i may consider. Else, there is really no reason to put into FD and savings account except for ATM purposes. If no need use cheque, then close the current account.

This is to make our local banks better. Let them realise they must not be complacent. Complacency has cost poreans and the pore a lot of reputation loss and money loss and resources loss and most importantly my face is lost in front of foreigners.

that money cannot compensate.